Shifting the paradigm

What’s in it for our industry – shifting the paradigm of private markets investing

The private markets are on the cusp of a revolution, with private markets assets under administration (AUM) predicted to more than double by 2030. Fund managers have grown and evolved from raising one fund every few years, to raising funds across multiple strategies and a wider investor base. Looking ahead, private wealth, not institutional capital, is expected to drive the next phase of growth for the asset class.

Retail investment is set to drive the next frontier in private markets

Alternative assets AUM will most likely exceed $30trn by 2030, with upside coming from non-institutional capital

Preqin | 2024

Are the private markets ready for private wealth? Yes but it’s not without challenges around

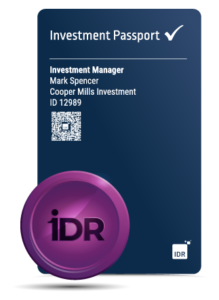

IDR is nothing short of a revolution for the investor onboarding process in the private funds market.

Jason Ment

Partner, StepStone

Paper-based, repetitive client onboarding is increasingly untenable. We have watched IDR earn the trust of clients, grow over 25,000 investor profiles and become regulated in a sophisticated and mature jurisdiction like Guernsey.

Tony Mancini

Tax Partner

IDR shortlisted in the 2024 Funds Europe Awards

IDR has been selected as a finalist in the European FundsTech Provider of the Year in the Investment

ArticleIDR puts client partnerships front and centre with CRM promotion

As IDR continues to grow, servicing some of the largest private markets fund managers in …

Follow us on LinkedIn

Subscribe to our newsletter

AML Roundup – Q2 2024

This edition includes the latest proposed US regulatory changes covering customer identification pro