Introduction

As we move into 2025, it’s time to say goodbye to a fundraising environment that has been challenging across the private capital landscape. A cloudy economic environment, stubborn inflation, and elevated financing costs were headwinds for sponsored-based M&A, along with an IPO market that has been sluggish compared to previous years. Investors have been reluctant to make new commitments due to a lack of distributions heading back to LPs (with the one exception being secondaries given their role in LP allocation management.)

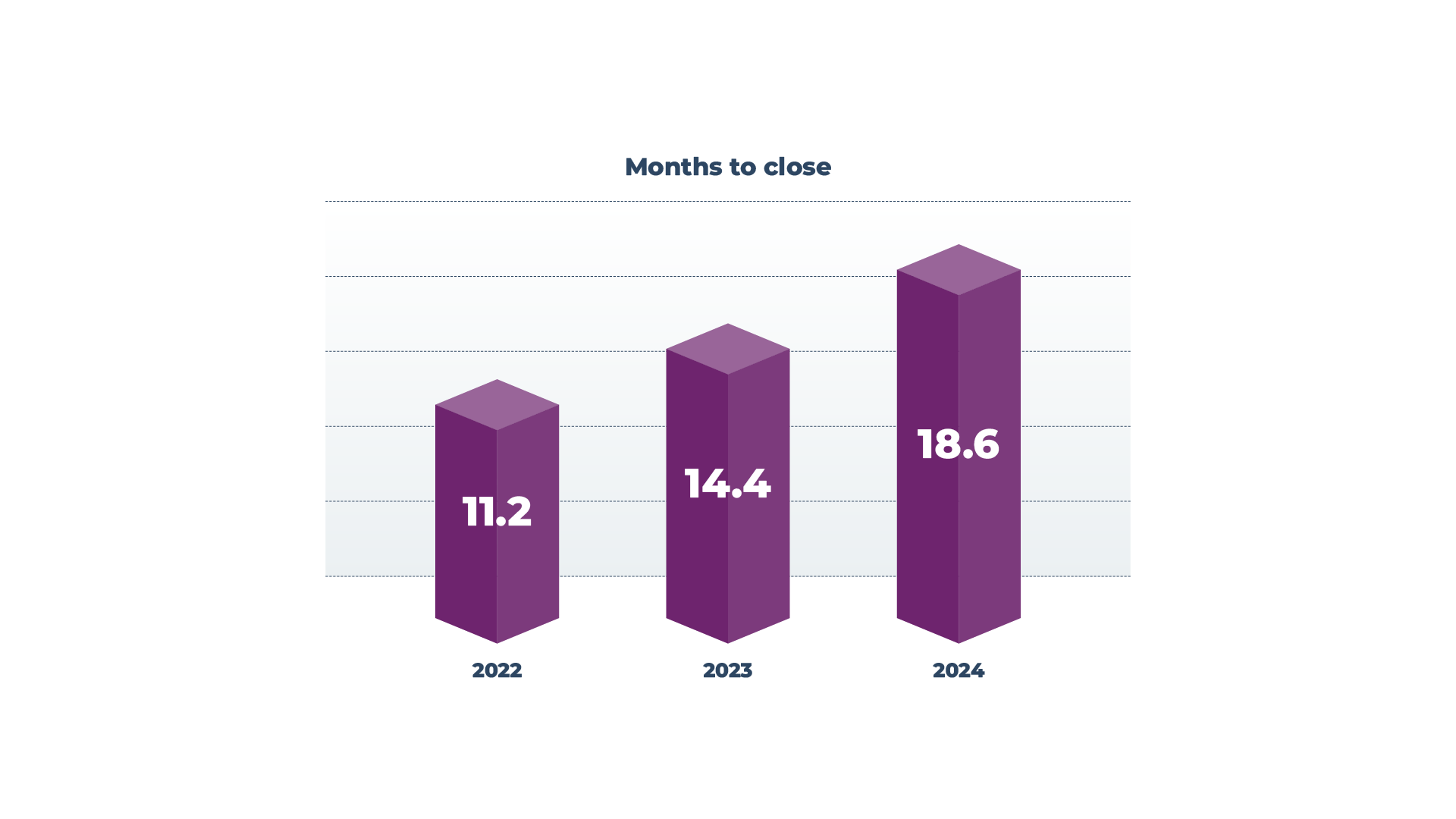

With LPs slowing their pace of commitments the last two years, the median time to close a private equity fund climbed to 18.6 months in H2 2024, up from 14.7 months in 2023 and 11.2 months in 2022, according to PitchBook’s Q2 2024 US PE Breakdown.

Will fundraising improve in 2025? There is reason for caution, but a number of factors point to a healthier fundraising environment next year.

1. Lower interest rates will fuel M&A, IPOs, and, ultimately, distributions

A more stable economic environment, coupled with lower inflation, lower valuations, and the prospect of declining interest rates, should close the bid-ask spread between buyers and sellers in 2025. With more deals being done, there will be more distributions back to LPs, which has been the biggest blockade to new commitments in 2024.

For its part, the IPO market has shown signs of life in Q4, with recent IPOs trading above their IPO price – giving confidence to another exit avenue for managers and future distribution opportunities for investors.

2. New technologies have reduced the friction in how managers onboard investors and close funds

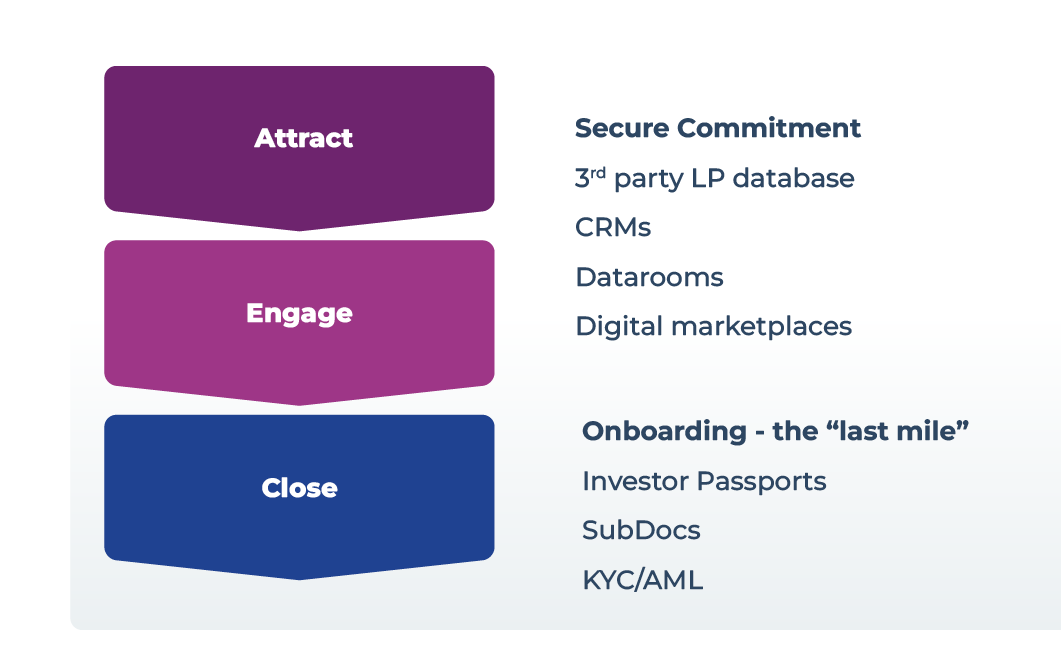

Everyone aims to hit their fundraising targets and closing dates, and PE-specific technology has greatly benefitted the investor relations part of the business. Most managers already use CRM systems and data rooms to engage, communicate with, and monitor prospective investors. However, it’s the “last mile”—the onboarding process—where things often get bogged down.

Fortunately, platforms facilitating subscription document completion and AML/KYC processes can significantly reduce the time needed to fully onboard new investors, helping managers meet their target close dates. This efficiency will be critical for any manager who wants to penetrate the HNW/retail market. If it takes a long time to onboard 500 investors, onboarding 5,000 retail investors with manual processes becomes even more daunting. With greater adoption of these technologies in 2025, more funds will be able to close faster, shortening fundraising times and increasing overall AUM.

3. LPs have indicated a willingness to increase contributions

Not since 2022 have LPs shown as much enthusiasm to boosting their private equity commitments as they are looking to do in 2025. In Private Equity International’s most recent LP survey, 45% of LPs have indicated they plan to allocate more to private equity managers in the next 12 months, with 48% planning to at least hold their commitments during the same time frame. This is a significant increase from what LP’s had planned in 2024, when only 31% of investors had planned to increase their PE commitments.

The strength of the equity markets in 2024 has relieved some of the pressure of the denominator effect, bringing allocations back into alignment within investment policy ranges, thus creating the opportunity to resume new commitments. LPs anticipate that the distribution pipeline will open back up with a more favorable economic background and lower interest rates as the exit environment turns more favorable for fund managers.

4. The retailisation push hits full force

One meaningful outgrowth of the fundraising challenges in the institutional world has been the industry’s manifest to tap into the retail and wealth marketplace with its approximate $150 trillion of investible assets. While there has been some success by the larger PE fund managers in the retail channel, 2025 could see a meaningful penetration into this market by a broader base of GPs.

Much like their institutional counterparts, over 70% of wealth advisors and their clients are planning to increase their allocations to the private markets, according to Hamilton Lane’s Private Markets Global Survey Insights. This bodes well for retail AUM growth as advisors become more comfortable placing private market funds into their clients’ portfolios.

If 2024 was the year to lay the groundwork, 2025 could see sizable assets being allocated to the private markets as:

- The education of RIAs, wealth managers and HNW investors about the benefits of the private markets continues, with dedicated allocations becoming commonplace

- Third-party private capital marketplaces continue to be favorably received by the wealth community

- Evergreen and hybrid products continue to come to market (Evergreen capital funds recently hit a recent high of AUM of $350bn)

- Product distribution channels evolve as private equity managers tap into the distribution capabilities of traditional managers through partnerships and M&A

In Europe, ELTIF 2.0 has opened the door to a wider array of permissible assets and fund structures, easing the way for EU-based private managers to enter the retail channel. Already, several new ELTIF products have been launched under the revised framework, with many more to come. However, this will most likely have only an incremental effect on 2025 fundraising, with assets expected to grow more slowly over time.

As technology has significantly contributed to the industry’s growth over the years, it will become even more crucial for fund managers seeking to exponentially expand their investor base. Technologies for raising assets, onboarding investors, ensuring compliance, and enhancing investor communication will play vital roles in the growth of the asset class beyond the institutional world.

5.Venture Capital, Real Estate and Private Credit will see an uptick

Whilst Venture Capital and Real Estate managers struggled to raise capital in 2024, there is a feeling that 2025 could represent a particularly good vintage year for LPs to invest as valuations find their bottom. With a resurgent IPO market in both the U.S. and Europe and a growing opportunity set to invest in AI-related start-ups, 2025 should see a return to fundraising form with a more broad-based range of VCs raising capital.

The general consensus in real estate is that valuations have stabilised and lower interest rates next year will allow managers to re-enter the fundraising market with more confidence – particularly as investors’ RE targeted allocation is at the low end of the range. Income producing strategies like real estate should find more favour next year in 2025

Private Credit fundraising is expected to finish the year strong and continue so in 2025 as LPs contend with lower interest rates in the public markets as well as many institutional investors now carving out dedicated allocations to private credit for the first time. It’s also worth noting that the popularity of evergreen fund structures, of which private credit is particularly suited, should provide meaningful tailwinds and AUM to a strategy that is growing in popularity with advisors and wealth managers.

Conclusion

With dealmakers feeling optimistic about lower interest rates in 2025, LPs looking to re-establish commitment pacing and a maturing high net worth market, there are green shoots peeking out that next year’s fundraising could be a particularly strong one. Factoring in advancements in how managers can leverage technology to meet their fundraising dates and targets, there is room for optimism 2025 will represent a strong fundraising year for many, if not all, private capital strategies.