It’s often said that alternative investments are sold, not bought so in today’s competitive fundraising environment, building strong investor relationships and delivering a seamless investor onboarding experience is crucial. Particularly as private markets fund managers aim to expand their investor base beyond institutions.

However, the onboarding process is all too often a point of friction. Disjointed systems, confusing forms, and repeated requests for personal information are frustrating for investors and add to the time and cost associated with fundraising for managers.

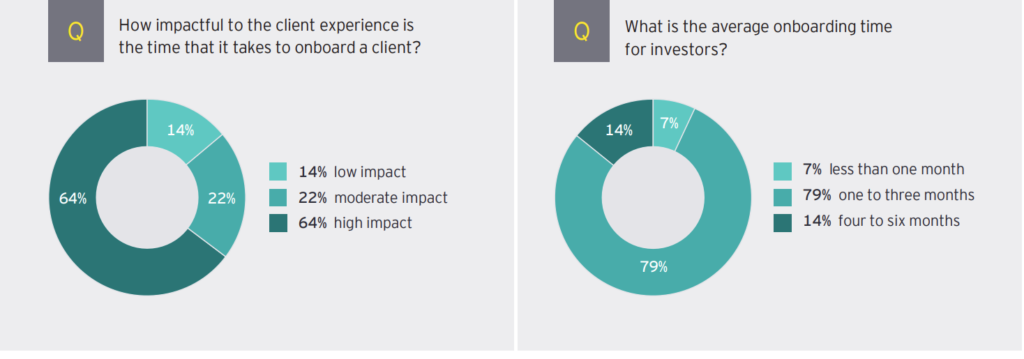

A recent EY report found that while 64% of fund managers acknowledged the significant impact of lengthy onboarding on the investor experience, less than 7% could onboard investors in under a month.

What steps can managers take to overcome these challenges and deliver a seamless investor onboarding experience?

- Streamline onboarding processes

Onboarding requires investors to submit subscription questionnaires, complete AML/CFT checks, and provide tax information. Often, this data is requested multiple times by different departments due to siloed working practices and disjointed systems.

Streamlining this process, as IDR does by consolidating all information in one platform, improves efficiency by at least 40%, benefiting both investors and managers.

- Approve investors once

Investors typically invest across multiple funds, requiring them to go through the entire onboarding process for each investment. IDR’s platform allows investors to authenticate once and create a pre-approved investment passport which they can re-use to fast track the onboarding process for future investments. Where investors are already approved on IDR’s platform, 65%-95% of subscription information will be pre-populated for subsequent investments1.

- Apply a tailored approach

Private markets are attracting a diverse range of investors. Presenting all investors with the same forms leads to confusion.

With more than 55,000 investors ranging from institutions and endowment funds to SWFs and individuals on our trusted hub we’ve developed a comprehensive set of intuitive questionnaires which can be tailored by investor type. Investors see only those questions that are relevant, making the process quicker and more accurate.

- Time critical investor support

The private markets onboarding process can be challenging for even the most experienced of investors. Timely access to human support is therefore essential, especially for retail investors who may require more guidance.

IDR’s legal and compliance experts are on-hand 24/7 to assist investors, ensuring faster completion with fewer errors. Over 90% of queries are resolved within 48 hours, expediting onboarding and thus enabling funds to close faster.

- Network effects

With over 50% of private markets investors globally already on our platform, the onboarding process is faster and more efficient. These benefits are further enhanced for follow on funds, as all repeat investors will be pre-approved.

Why not join us?

To find out more about how IDR is transforming the private markets investor onboarding process for more than 55,000 investors across 8,400 funds and 500 fund managers explore our solutions.

1 – May vary from fund to fund where fund specific questionnaires need to account for different laws and regulations